Legacy Giving

How would you like to be remembered by your loved ones and by your community? You have the power, right now, to create a very meaningful and lasting reflection of what you value by leaving a bequest to the Alberta Children’s Hospital Foundation in your Will.

Important Information for your Legacy Gift

Legal Name: Alberta Children’s Hospital Foundation

Charitable Registration Number: 13037 3244 RR0001

Future Gifts lead to Future Cures

Legacy giving is an easy and beautiful way to share the success you’ve experienced in life while ensuring many generations of children and families will benefit from the best pediatric health care possible.

Even with the exceptional care provided by the Alberta Children’s Hospital, each year hundreds of children in our community get sick with no known cure. Hundreds more face treatments that are so harsh, they leave serious lasting side effects. Scientists at the Alberta Children’s Hospital and the Alberta Children’s Hospital Research Institute know that we need to do better.

You have the opportunity to help researchers move medicine forward for children. With your help, they can better understand what makes kids sick, predict and prevent health issues, learn how to diagnose more quickly and accurately, and develop new therapies tailored to the special needs of children as they develop and grow.

Your legacy gift will support life-saving, life-changing pediatric research. Should you wish to designate your gift to another area of interest at the hospital, we would be happy to arrange that for you.

Your thoughtfulness today will build a healthier tomorrow.

Legacy Challenge

Right now, there is an unprecedented opportunity for those leaving a gift in their Will. Through the Legacy Challenge, these future gifts will improve outcomes for the kids and families of tomorrow and at the same time, will also have a direct, meaningful impact today.

LEARN MORE

Will Power

Your Will is powerful. It can help set your loved ones up for success and support a cause that is important to you. Your legacy can live on in both your own family and the thousands of families who will rely on specialized care every year at the Alberta Children’s Hospital.

By leaving a legacy gift, you are leading by example. You are showing your loved ones that giving back to your community is important to you. Your gift will make the community a better place for them to live and perhaps it will even inspire them to give back themselves.

- A bequest (gift in your Will) One of the simplest ways to make a significant gift – perhaps larger than you ever thought possible – is a gift made in your Will, a bequest to the Alberta Children’s Hospital Foundation.

- A gift of shares or securities A tax effective way to help kids and families at ACH now or in the future as part of your estate planning is a gift of shares or securities.

- A gift of life insurance For a modest cost, you can make a substantial gift by naming the Alberta Children’s Hospital Foundation as the beneficiary of a life insurance policy.

'Giving Smarter ' at Tax Time

Free Webinar

You can make a bigger contribution to support kids and families in our community without using any of the money you need now. There are also tax advantages that could benefit your estate and loved ones. Simply put, a gift in your Will can do more than you think. Learn more in this free, 30-minute webinar hosted by Will Power.

WATCHJoin our Family of Hope

The Family of Hope is a special group of people who have let us know they have left a gift in their Will to the Alberta Children’s Hospital Foundation. We call these generous people “family” because they share a vision for a healthier future and together, they are turning that vision into reality. One family’s gift is another family’s hope.

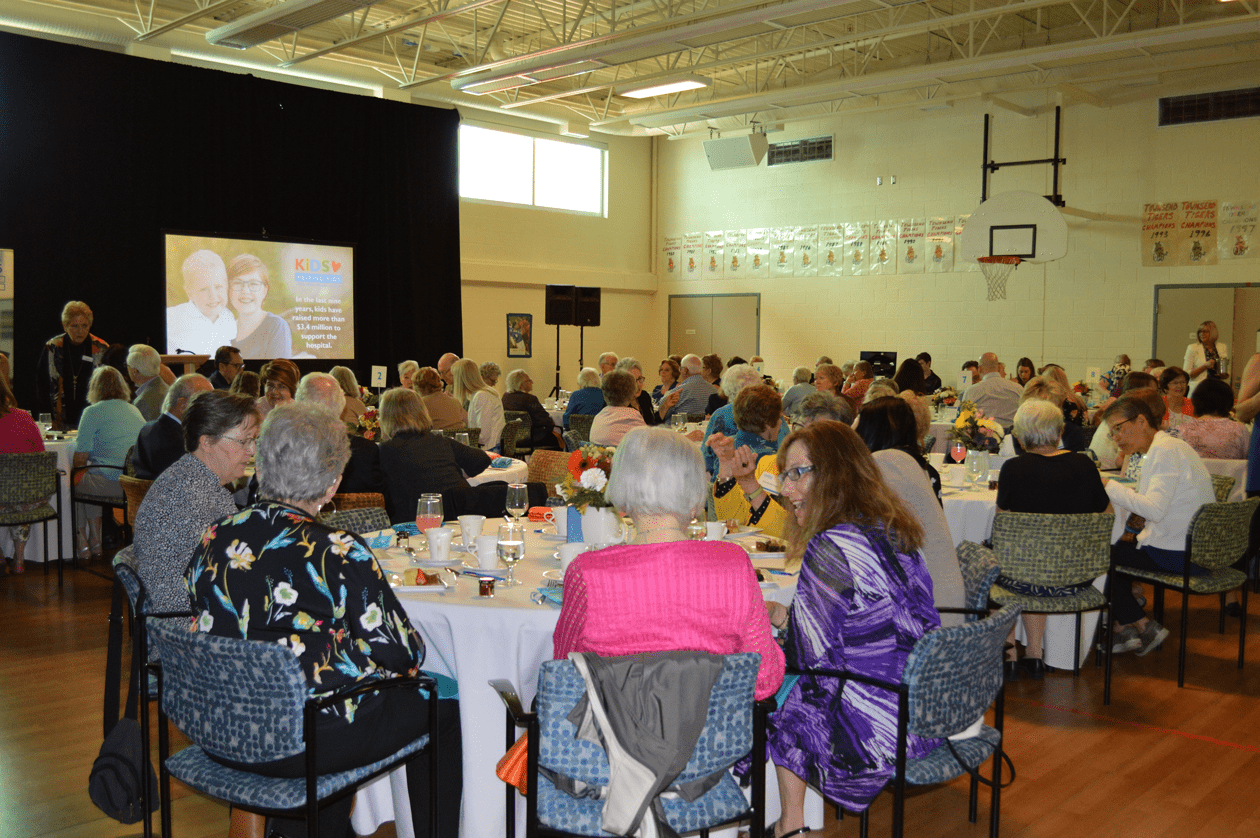

We honour and celebrate our Family of Hope members at an Afternoon Tea each spring, and members are eligible for special recognition at the hospital, invitations to Foundation events and a subscription to our semi-annual newsletter, Just4Kids. You can join our Family of Hope simply by letting us know you’ve left a gift to the Alberta Children’s Hospital Foundation in your Will.

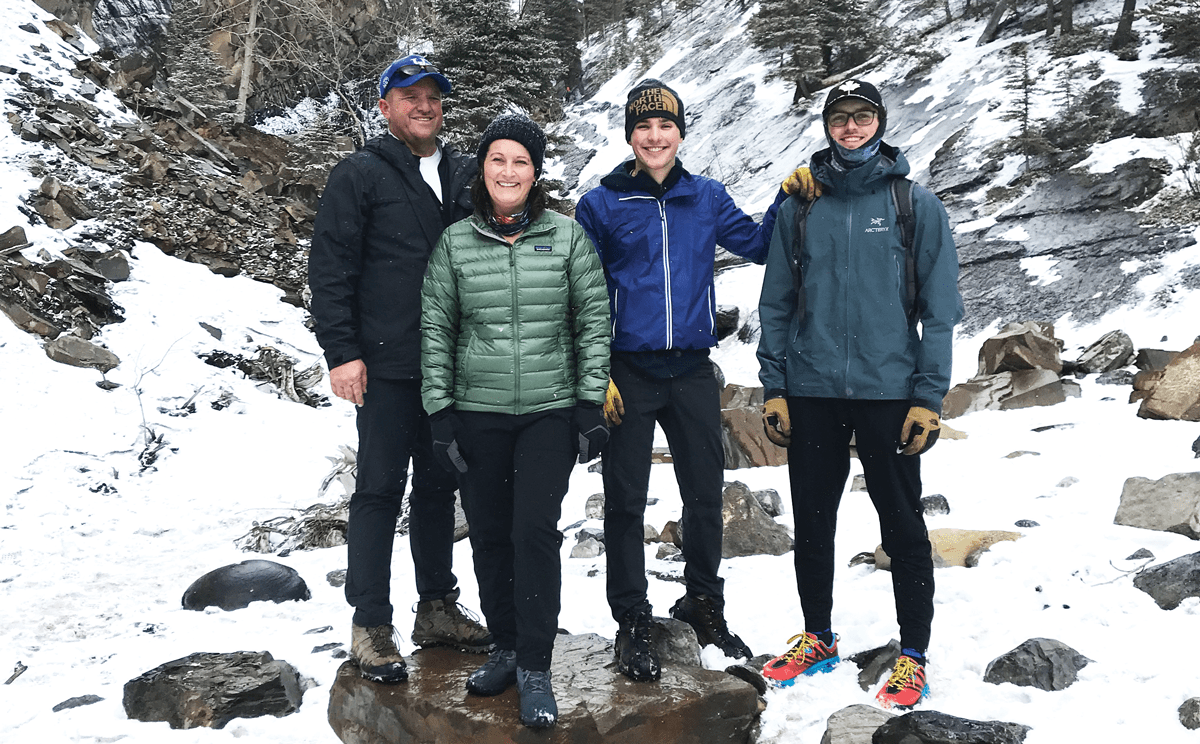

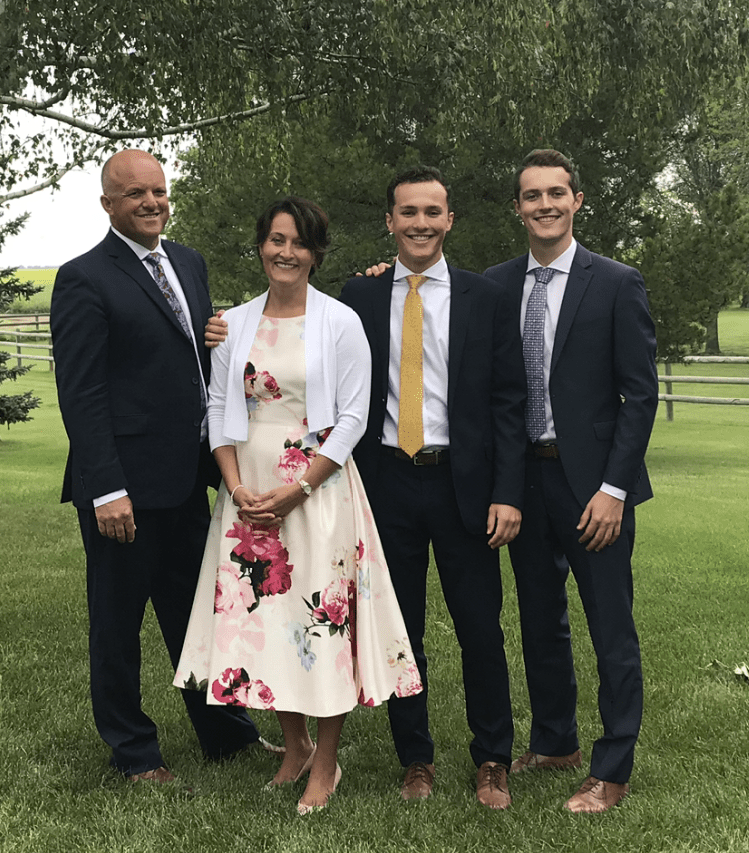

For a quarter of a century, Lana and Peter Cissell have owned and operated grain farms in Alberta. It’s what they know, what they’re good at and where they feel at home. Despite the long days and hard work that goes into managing a farm operation, Lana and Peter also have some other very important roles: Mom and Dad to their two sons, Carter and Justin.

Living on a farm in rural Alberta meant that if the boys ever needed medical attention, they had to drive into Calgary for help.

“We have relied on the Alberta Children’s Hospital for things like broken bones and concussions – nothing major – but we were so grateful that the care and expertise was there for us when we needed it. We felt very blessed to have that hospital close by,” says Lana.

Inspired by the kindness and expertise they witnessed, Lana and Peter made a special commitment several years ago. They decided to leave a legacy gift to the Alberta Children’s Hospital in their Will. This gift – also known as a Bequest – will benefit future generations of families by advancing the research and technology available to specialists.

It’s something the Cissells feel strongly about – leaving a legacy of “top-notch care” for families of sick and injured children years down the road. They have also discussed the gift with their sons, who are both in their 20s. They hope to have inspired their boys to remember the importance of giving back to our community.

“We always want the Alberta Children’s Hospital to be the best it can be, to be leading-edge, to have the most innovative procedures and continue to offer such wonderful family-centred care,” says Lana. “This is something we can do to ensure that quality of care continues long into the future.”

Give a Gift of Securities

Making a gift of securities is a tax-effective way to help the kids and families at the Alberta Children’s Hospital now or in the future.

Did you know?

If you donate publicly traded securities directly to the Alberta Children’s Hospital Foundation and they have increased in value, you do not have to pay tax on the capital gains.

Publicly traded securities include:

- Public company shares

- Mutual fund units

- Bonds

All gifts of securities to Alberta Children’s Hospital Foundation are documented by execution of a Deed of Gift of Securities

Download Deed of Gift of Securities

Step 1.

The donor will execute the Deed of Gift and return it to the Foundation. The Deed may be returned to the Foundation by email to Sheelagh Mercier at smercier@achf.com or Krista Lanigan at klanigan@achf.com

Step 2.

The Foundation will review the Deed of Gift and decide whether it can accept the gift of securities. The Foundation may need to obtain professional advice and services when assessing the gift of securities.

Acceptance occurs when the Deed of Gift is executed by the Foundation.

For the purpose of valuation, the fair market value will be determined on the date the securities are received by Peters & Co. As a general rule fair market value shall be the closing price of the securities on the date of receipt by Peters & Co.

Step 3.

The Foundation will provide the donor and Peters & Co. with an executed copy of the Deed of Gift.

Step 4.

Once Peters & Co. confirms receipt of and valuation of the gift of securities as described in the Deed of Gift, the Foundation may issue a charitable donation or acknowledgement receipt to the donor.

Steps to assist in making a gift of securities to Alberta Children’s Hospital Foundation:

- Electronic Transfer (Broker to Broker):

- The donor will notify his/her broker of intent to gift securities to the Foundation.

- The Foundation maintains a trading account with Peters & Co. Limited

- Our Financial Institution Number is #T077; and

- Our Account is #01501592.

- Instruction to Peters & Co. Limited should indicate “for deposit to the account of Alberta Children’s Hospital Foundation, account #01501592”.

- Manual Transfer of Share Certificate:

- Where the share certificates are registered in the donor’s name, the donor will need to provide:

- the share certificate(s);

- signed Power of Attorney to affect a transfer of shares (forms can be supplied by the Foundation), together with a letter stating that the share certificate(s) are for deposit to the account of the Alberta Children’s Hospital Foundation.

- Where the share certificates are registered in the donor’s name, the donor will need to provide:

The share certificates should be UNSIGNED and hand delivered or sent by courier to the Foundation’s broker:

Kim Bottrell

Peters & Co Limited

2300 Jamieson Place 308

4 Ave SW Calgary, AB

T2P 0H7

Direct: 403.261.2236

CUID #: ‘PECC’

DTC #:5014

If you are using a courier, for security reasons we strongly suggest you use a separate courier for the Power of Attorney.

- Where the share certificate can be registered to the Foundation’s name, the donor should request his/her financial institution to register the share certificate(s) to “Peters & Co. in trust for the Alberta Children’s Hospital Foundation”.

- The share certificate(s) can then be delivered and deposited directly into the Foundation’s account at Peters and Co. at their address as noted above.

If you have any questions, please contact Sheelagh Mercier at 403-955-8837 or smercier@achf.com or Krista Lanigan at 403-955-8867 or klanigan@achf.com or Reception at 403-955-8818.

Let’s Talk

Have you already made a gift in your Will to the Alberta Children’s Hospital Foundation? Please let us know. Would you like more information about legacy giving? We are happy to chat at a time and in a place that is most convenient for you — perhaps over the phone, at a coffee shop or in your own living room. Feel free to reach out to us directly!

Heather Stevens

Heather Stevens

Charitable Gift Planner

403.955.8847

hstevens@achf.com

Sheelagh Mercier

Charitable Gift Planner

403.955.8837

smercier@achf.com

*We encourage you to talk to your family about your plans and seek professional legal, estate planning and/or financial advice when making decisions about your Will.

Undesignated Bequest

Residual Bequest: Designates all or a portion of whatever remains after all debts, taxes, expenses and all other bequests have been paid.

“I give _________[a portion of, example: “25% of”; all of, example: “100% of”] the rest and residue of my estate to the Alberta Children’s Hospital Foundation, in the City of Calgary, Alberta, to be used for such purposes as the Board of Directors of the Alberta Children’s Hospital Foundation may from time to time determine. I declare that the official charitable donation receipt shall be a sufficient discharge of my Executor.”

Specific Bequest: Directs that the Alberta Children’s Hospital Foundation receives a specific amount or a certain kind of property, for example, a gift of shares.

“I give _______ to the Alberta Children’s Hospital Foundation in the City of Calgary, Alberta, to be used for such purposes as the Board of Directors of the Alberta Children’s Hospital Foundation may from time to time determine. I declare that the official charitable donation receipt shall be a sufficient discharge of my Executor.”

Designated Bequest

Gifts may be directed to a particular area of the hospital. These gifts may also be residual or specific. “I give ________ to the Alberta Children’s Hospital Foundation in the City of Calgary, Alberta, to be used for ___________ child health and wellness research at the University of Calgary and the Alberta Children’s Hospital. I declare that the official charitable donation receipt shall be a sufficient discharge of my Executor.”

Power to Vary Clause: We recommend that you include language that permits the Alberta Children’s Hospital Foundation to use the gift for a different purpose if circumstances change that make it impossible or impracticable to carry out the original purposes.

“In the event that, in the opinion of the Board of Directors of the Alberta Children’s Hospital Foundation, it should become impossible, inadvisable, or impractical to apply this gift for said purpose, the gift may be used for other purposes consonant with the spirit and intention of this gift.”

We strongly encourage you to talk to your family about your plans and seek professional legal, estate planning and/or financial advice when making decisions about your gift to the Alberta Children’s Hospital Foundation.

For more information, please contact Sheelagh Mercier at 403-955-8837, smercier@achf.com or Heather Stevens at 403-955-8847, hstevens@achf.com

You play an instrumental role in helping establish plans to support the Alberta Children’s Hospital into the future. Thank you for your expertise.

We would be happy to connect with you to answer any questions, discuss your client’s hopes for their gift and thank them for the commitment they are making. If they are open to sharing, we would love to know the story or inspiration behind their gift and share the impact and advances made in pediatric care and research that are possible thanks to legacy giving.

Please reach out directly with questions or comments.

- Electronic Transfer (Broker to Broker):

- The donor will notify his/her broker of intent to gift securities to the Foundation.

- The Foundation maintains a trading account with Peters & Co. Limited

- Our Financial Institution Number is #T077; and

- Our Account is #01501592.

- Instruction to Peters & Co. Limited should indicate “for deposit to the account of Alberta Children’s Hospital Foundation, account #01501592”.

Alberta Children’s Hospital Research Institute: research4kids.ucalgary.ca/

CAGP WillPower: willpower.ca

Government of Alberta – Information on Wills:

justice.alberta.ca/programs_services/wills/Pages/default.aspx?WT.svl=programs

CRA Charity Page: cra-arc.gc.ca/chrts-gvng

Sign up for our newsletter